Breaking Away

On Strong & Sustained Follow Through?

The Bottom Line

The market is attempting to break away from a multi-month consolidation.

The odds favor upside follow-through, but confirmation is still required.

This is not the moment to chase or fade. It is the moment to stay aligned and let price do the work.

The Opportunity This Week

U.S. markets are attempting to extend the uptrend as the new year gets underway.

The odds favor follow-through rather than a bull trap, but confirmation must come from price.

That gap between attempt and confirmation is where the opportunity sits right now.

The Setup

Rather than focusing on headlines and narratives, the key question is whether this early January breakaway sees strong and sustained upside follow-through, or whether it fades back into the prior range.

That distinction will define the opportunity set.

The short-term structure continues to behave like a breakout attempt rather than a rejection.

Pullbacks have remained contained and demand has shown up quickly on weakness. Support near S&P 6900 is holding.

That keeps probabilities skewed higher, but confirmation is still required.

Structure and Targets

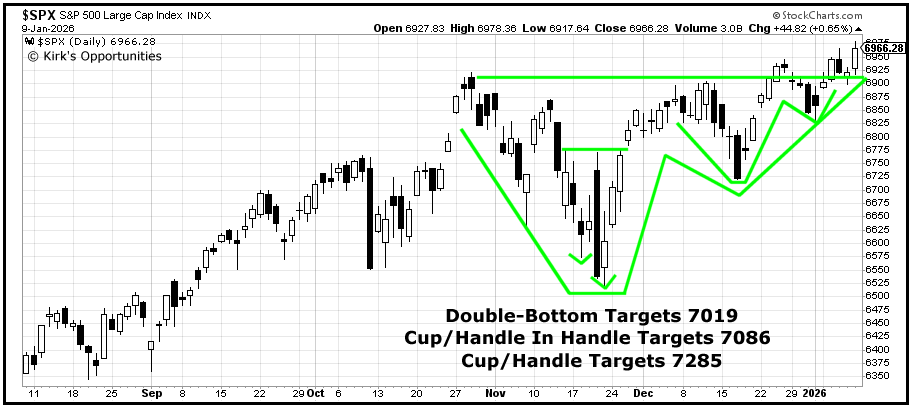

The daily chart shows the broader structure clearly. This move is resolving from a multi-month consolidation within an established uptrend.

The next two upside reference points sit at S&P 7019 and S&P 7086, both within close reach.

Capturing these levels would represent a meaningful extension of the trend, not a top.

This chart defines the opportunity and the risk in one view, including the breakout zone, upside targets, and key support at the December and November lows.

Will This Be A Repeat?

Every breakout attempt raises the same question.

Is this another push that stalls and fades, or the start of something more durable?

Markets often require several attempts before a move sticks.

That’s why the focus is not on the breakout itself, but on what happens after it.

Acceptance matters.

Follow-through matters.

Time matters.

This historical view exists to reinforce discipline. Failed breakouts are always a risk until price proves otherwise.

Participation Is Improving

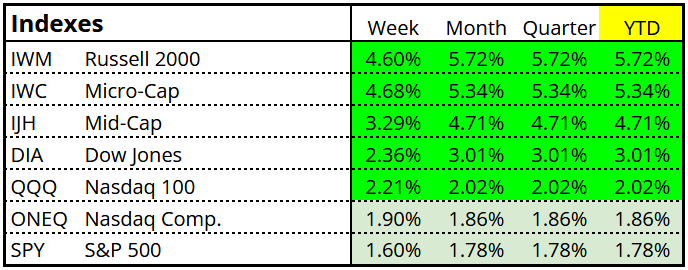

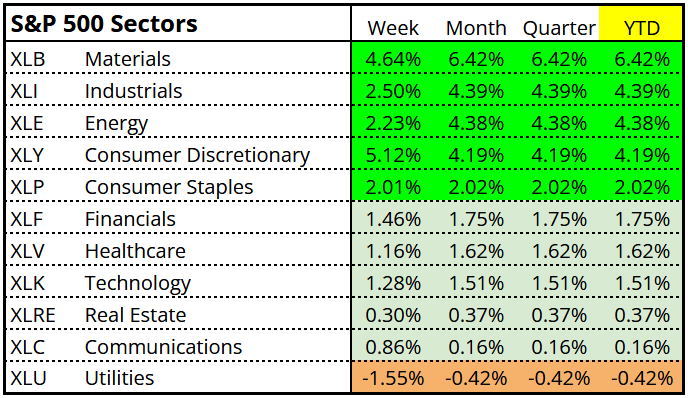

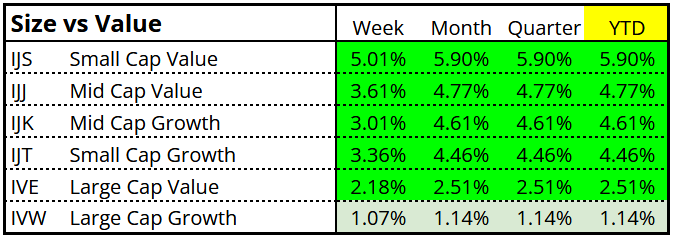

One of the more constructive aspects of this move has been the improvement in participation beneath the surface.

Small caps are not lagging. They are leading. Cyclicals are participating. Leadership is broadening rather than narrowing.

Markets that are about to roll over rarely look like this.

What Matters and What Doesn’t

Rates remain elevated but stable. The dollar has held firm. Oil has moved higher on supply and geopolitical considerations. Bitcoin continues to consolidate.

And, Fed Chair Powell is now under criminal investigation.

These factors can influence short-term volatility.

They do not override price structure.

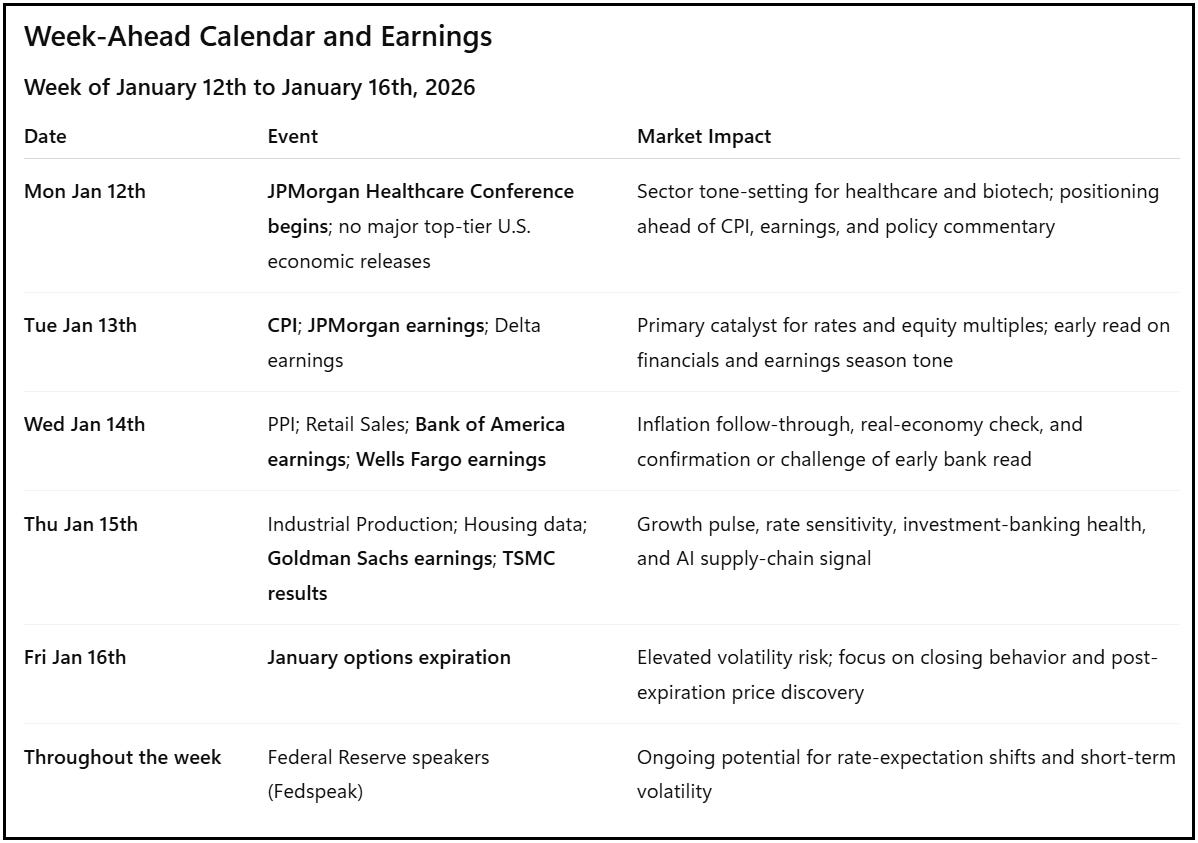

Known Catalysts This Week

This is a heavy week for potential volatility, including inflation data, earnings releases, Federal Reserve commentary, and January options expiration.

None of these events change the framework on their own.

What matters is how price responds.

Strong reactions that hold support would reinforce the breakout attempt. Weak reactions that fail to recover would raise the odds of a return to the range.

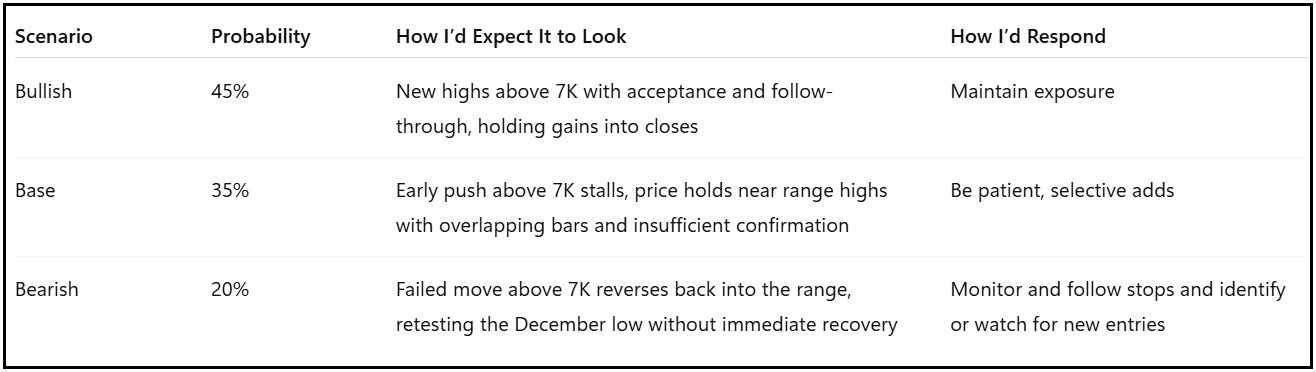

Probabilities

Based on the current price action, the probabilities remain unchanged from last week, pending confirmation.

The following framework outlines how I am thinking about potential paths over the coming week.

Next Week Scenario Framework

Most Likely Path

A push above recent highs that requires time and acceptance to confirm, with patience favored over anticipation unless follow-through develops.

How I’m Approaching This

I’m not fading strength simply because prices are at new highs.

I’m also not chasing.

I’m maintaining non-leveraged exposure while price remains constructive, prepared for volatility, and letting price dictate when something has changed.

Closing Thoughts

This still looks like a market that wants higher prices.

Not necessarily in a straight line.

Almost certainly with pauses and tests.

Until price says otherwise, the opportunity remains alignment with the trend, clear risk definition, and patience over anticipation.

For what I’m working on, thinking about, and using between these longer updates, be sure to check my notebook.

Have a wonderful week!

“The market gives opportunities every day. Discipline determines who captures them.” – Jesse Livermore