Early Year Playbook

What is leading, what is lagging, and what it means

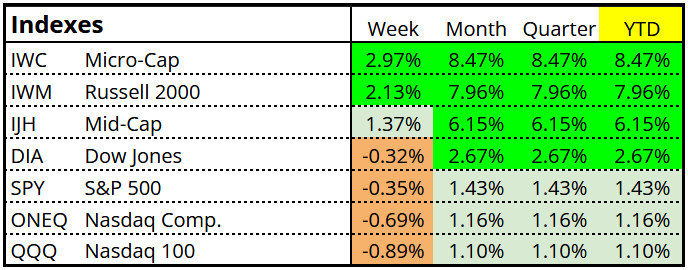

The Leadership Shift

Market leadership has decisively rotated away from mega-caps toward small and mid-caps, commodities, crypto, and global equities. Breadth and relative strength confirm that capital is rotating rather than retreating.

The Visual Divergence

The charts below tell the story. While small and mid-cap indexes (top row) are confirming strong breakouts with sustained momentum, the mega-cap proxies (bottom row) are struggling to keep up.

Small & Mid-Caps Are Leading

Small & Mid-Caps Are Leading: Smaller and mid-cap indexes are outperforming with strong follow-through on their breakouts. Leadership is being confirmed by price action and relative strength.

Large Caps Are Lagging. This divergence signals rotation, not breakdown. The safety trade is currently the lagging trade.

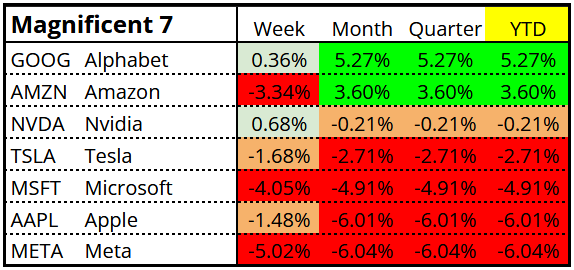

The Drag: Magnificent 7 Fatigue

Why are the Nasdaq & S&P 500 lagging? The mega-cap tech heavyweights are hindering more than helping as earnings approach.

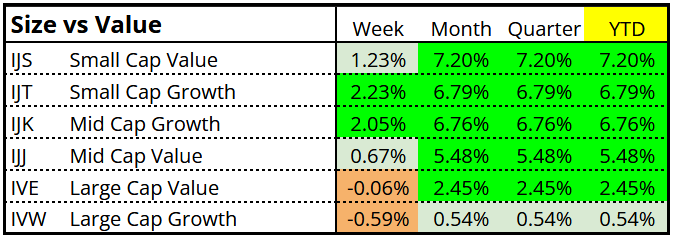

Size Matters More Than Style

Relative performance favors smaller companies over large, regardless of value or growth classification. Investors are prioritizing opportunity and upside over perceived safety.

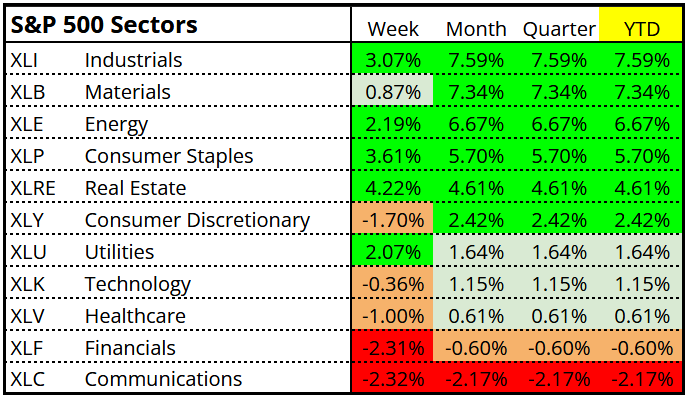

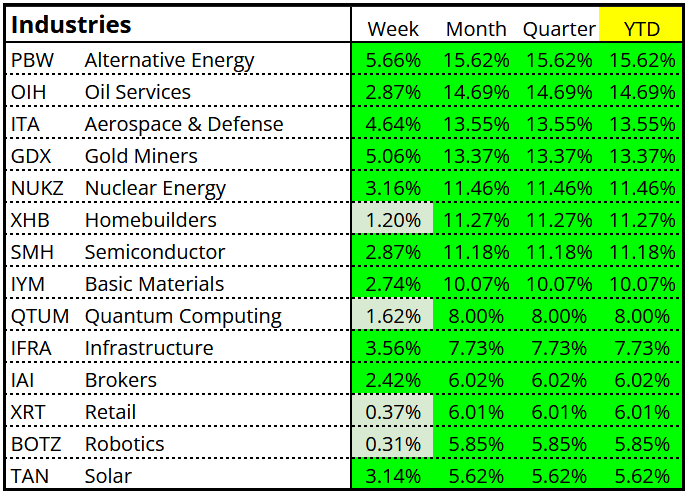

Where the Money is Flowing

This is an environment that rewards selectivity. Capital is flowing decisively into specific sectors and industry groups.

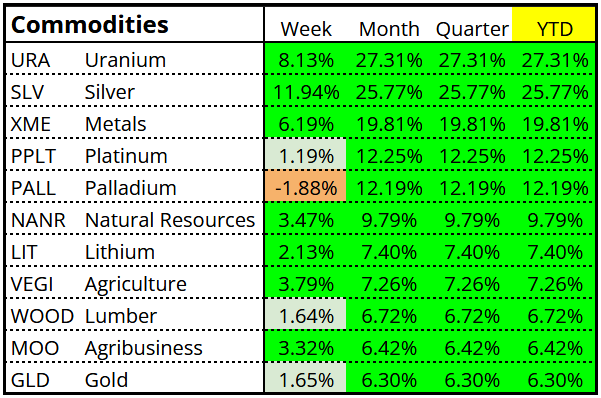

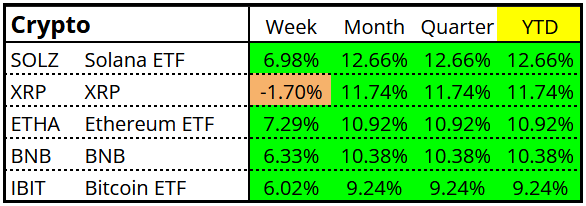

The Strongest Themes:

Commodities: Strength in Uranium (+27% YTD), Silver, and Metals points to persistent inflation hedging and real-asset exposure.

Crypto: Renewed upside in Solana and Bitcoin suggests risk appetite is expanding.

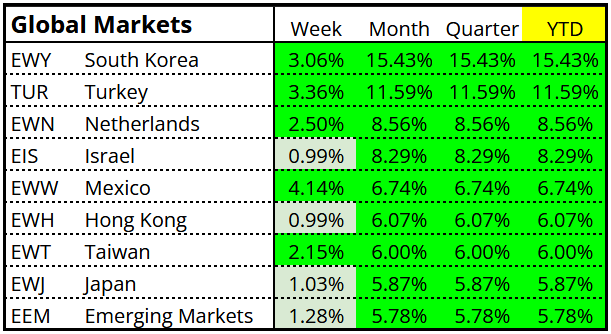

Global Markets: International equities like South Korea and Turkey are outperforming the S&P 500.

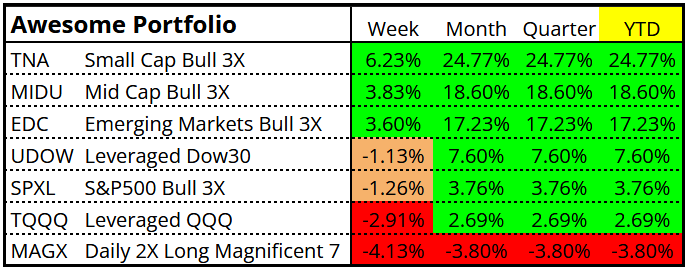

Leveraged Instruments Confirm the Trend

Leveraged exposure to small/mid caps and emerging markets aligns with leadership seen in cash indexes. This confirms conviction, not short-term trading noise.

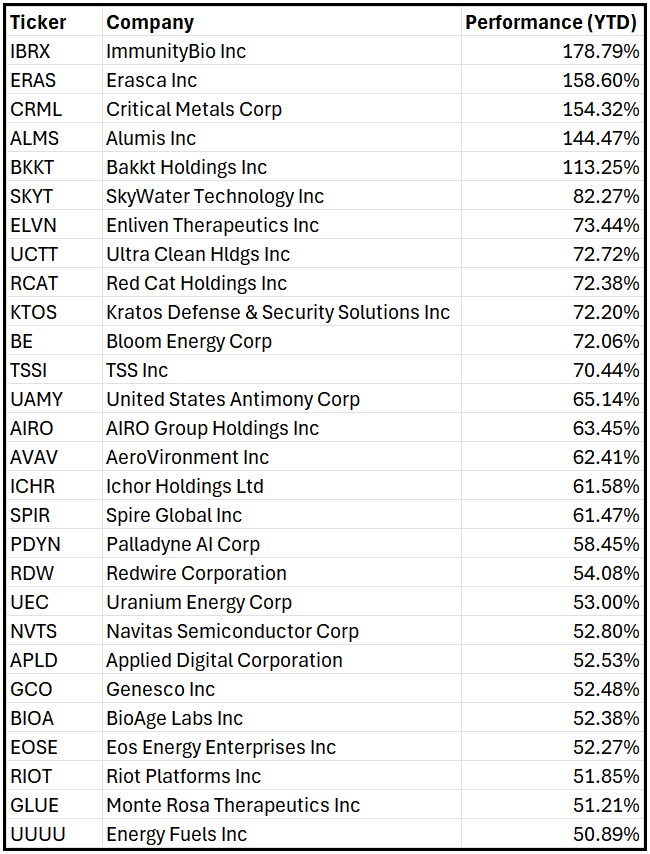

Proof of Participation

Perhaps the most bullish signal is the participation beneath the surface. A meaningful number of Russell 2000 stocks are already up over +50% this year.

Practical Trading Implications

Stocks act like members of a pack, especially in trending markets. Your edge comes from identifying when that alignment is working for you rather than against you.

Weak Sector = Headwinds: If the sector is weak, individual stock breakouts have significantly lower odds of follow-through.

Strong Sector = Tailwinds: If the sector is strong, even average stocks often act better than their fundamentals suggest.

The “Triple Alignment” Edge: The highest probability setups occur when the Stock, Industry Group, and Sector are all moving in the same direction.

Don’t Fight the Flow: Fighting sector trends significantly reduces your probability of success, even if the individual chart looks perfect.

What This Is Not

• Not a risk-off environment.

• Not a failure of the bull market.

It IS a leadership rotation away from crowded mega-caps and toward under-owned areas with improving momentum

Why Now?

• Mega-cap leadership is crowded and increasingly earnings-sensitive.

• Valuation and positioning pressures are highest at the top.

• Investors are rotating toward higher beta and operating leverage.

• Global growth and commodity-linked exposure are gaining traction.

The Bottom Line

It is not a defensive market. It is a rotational one.

Leadership is broadening into areas that historically thrive when risk appetite expands.

Respect the rotation.

Stay aligned with relative strength, remain selective, and let the price action confirm the opportunity.

“Investing is not about beating others at their game. It’s about controlling yourself at your own game.”- Benjamin Graham

Good insights to current themes.

Thank you for your insights. Benjamin Graham's quote has stood the test of time. It is important to realize that playing the market is not just about winning but surviving. Charles D. Ellis captures this concept in his book, "Winning the Loser's Game." By leveraging compounding and time, we can achieve our goal of financial independence. Thanks again