The First Five Days

A Brief Look To The Past For A Peak Ahead

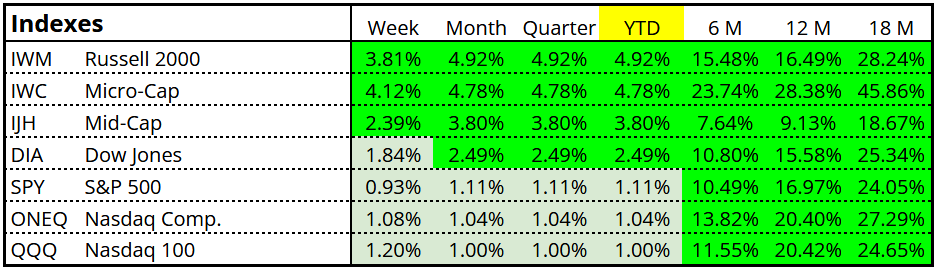

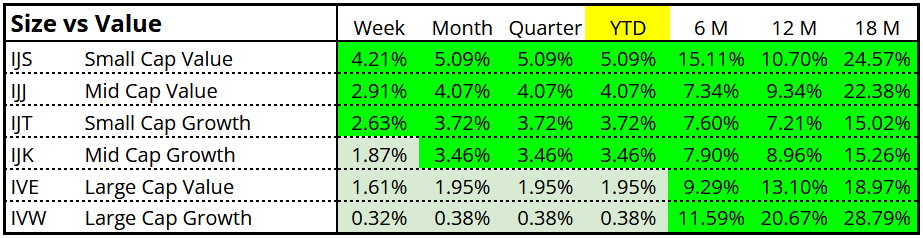

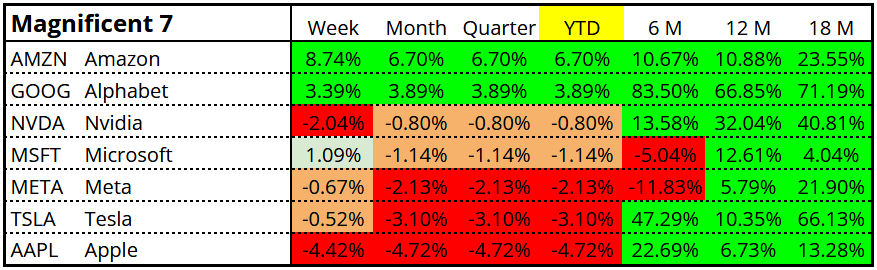

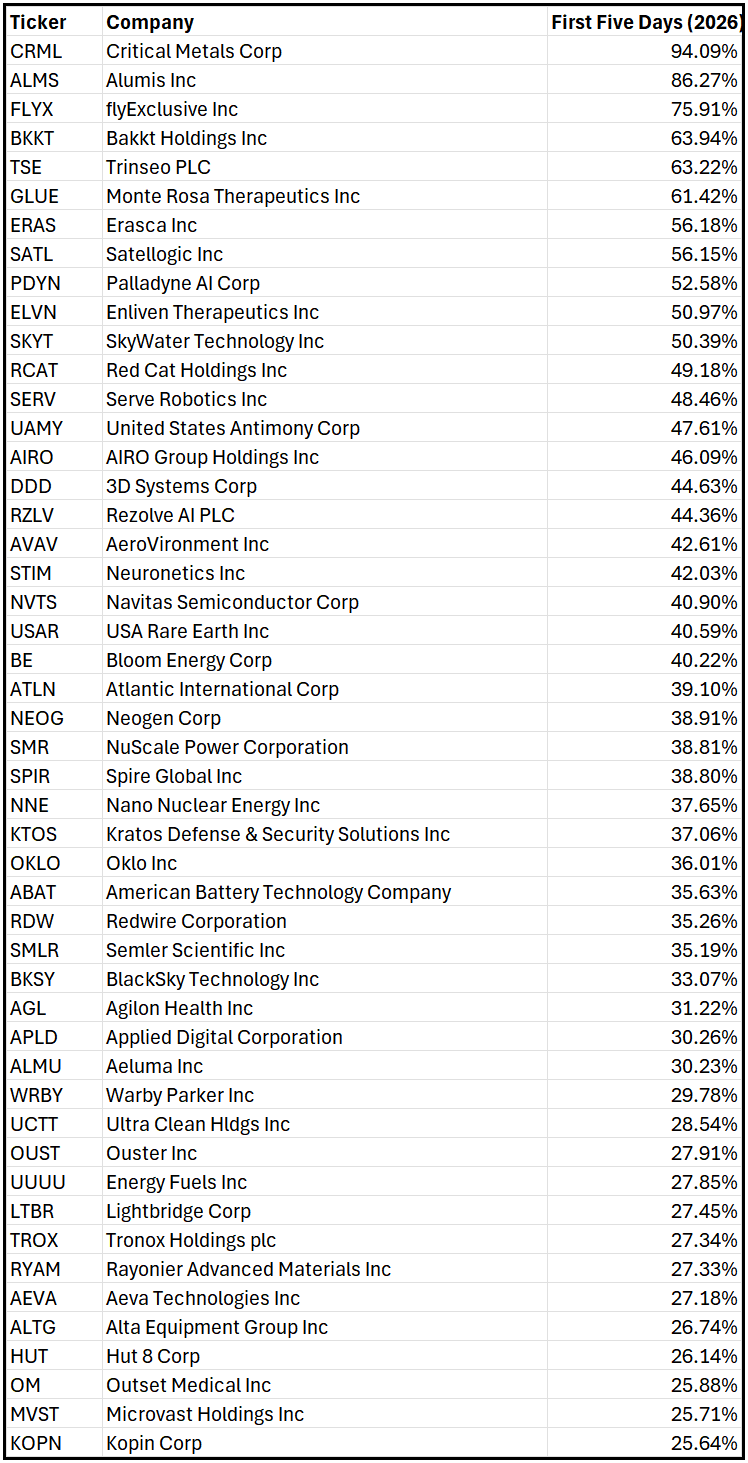

5 days in and the smaller caps are out in front:

As you see, the S&P 500 is up +1.11% for the first five days of the year.

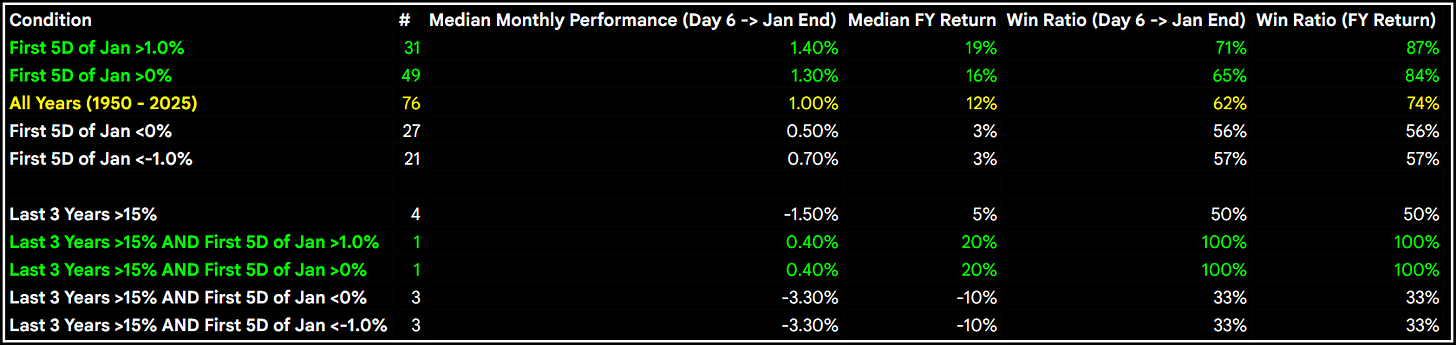

When the first five days are positive and up +1%, the forward performance has been positive with an 87% win ratio and median full year return of +19%:

The table above also shows how relatively rare it has been to be positive and up +1% after three years in which the S&P 500 was up greater than +15% each year in a row.

There was only one year in which this happened: 1999

For those who were not around back then or involved in the markets, in 1999 the internet boom was raging. And the S&P 500 rallied another +19.5% for a 4th straight positive year in 1999. An impressive yearly winning streak following a gain of +27% in 1998, +31% in 1997, and +20% in 1996.

What followed after 1999? Interesting times filled with opportunities.

We’ll talk more about that later, my friends!

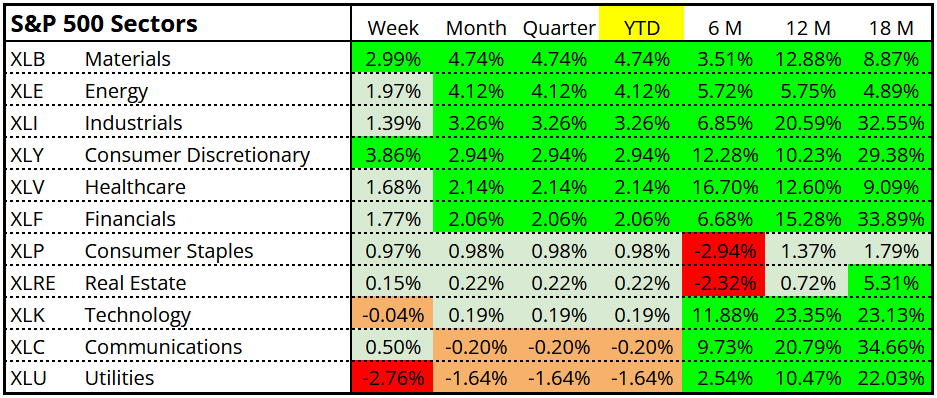

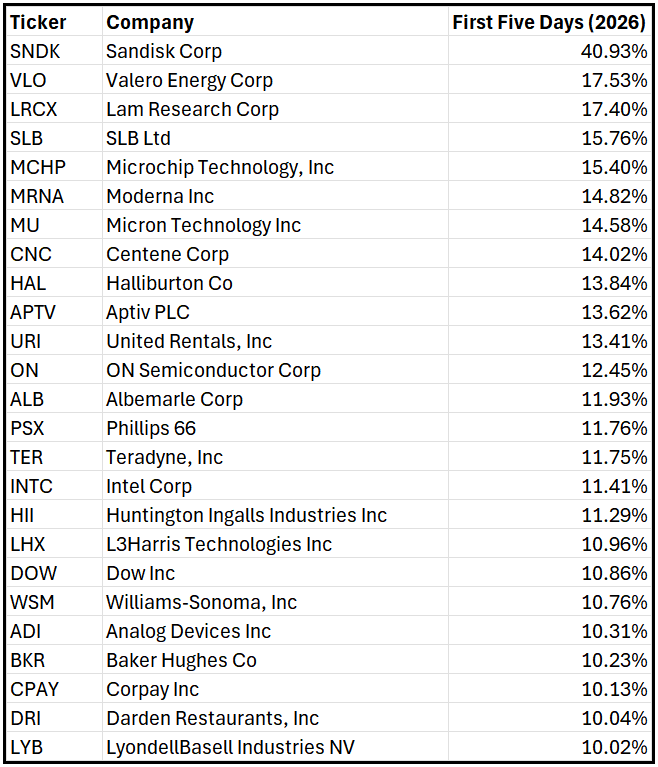

Let’s take a brief look at whats out in front 5 days in….

Materials, Energy, and Industrials

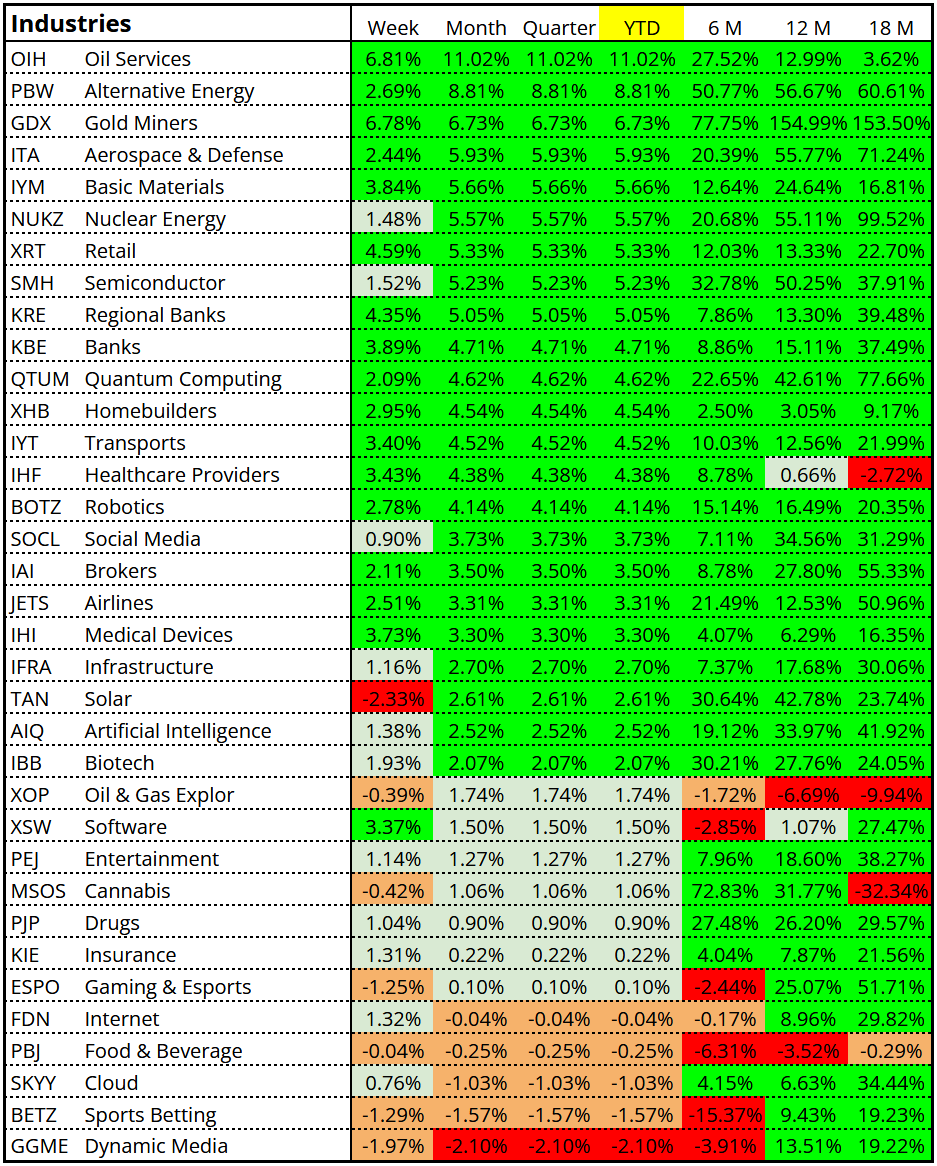

Oil Services, Alternative Energy, Gold Miners, Aerospace & Defense, Nuclear Energy, Retail, Semiconductor & Banks

Small/Mid Cap Value

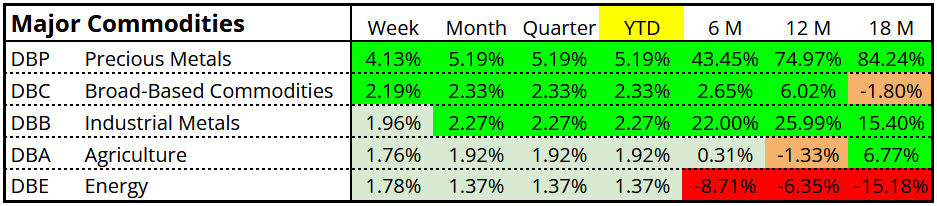

Precious Metals

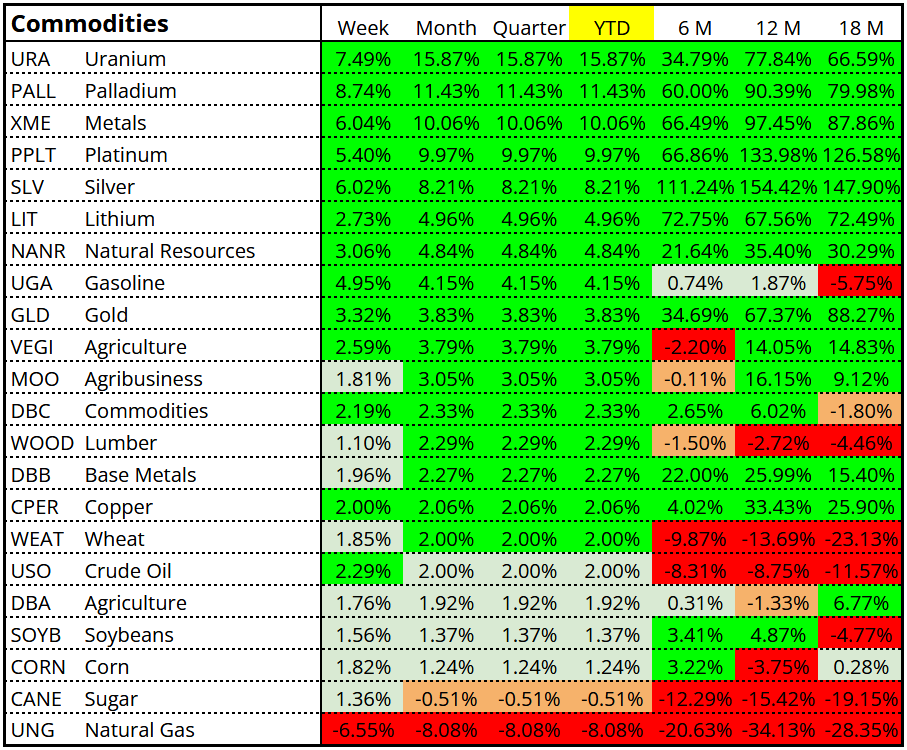

Especially The UMs (Uranium, Palladium, Platinum, Lithium)

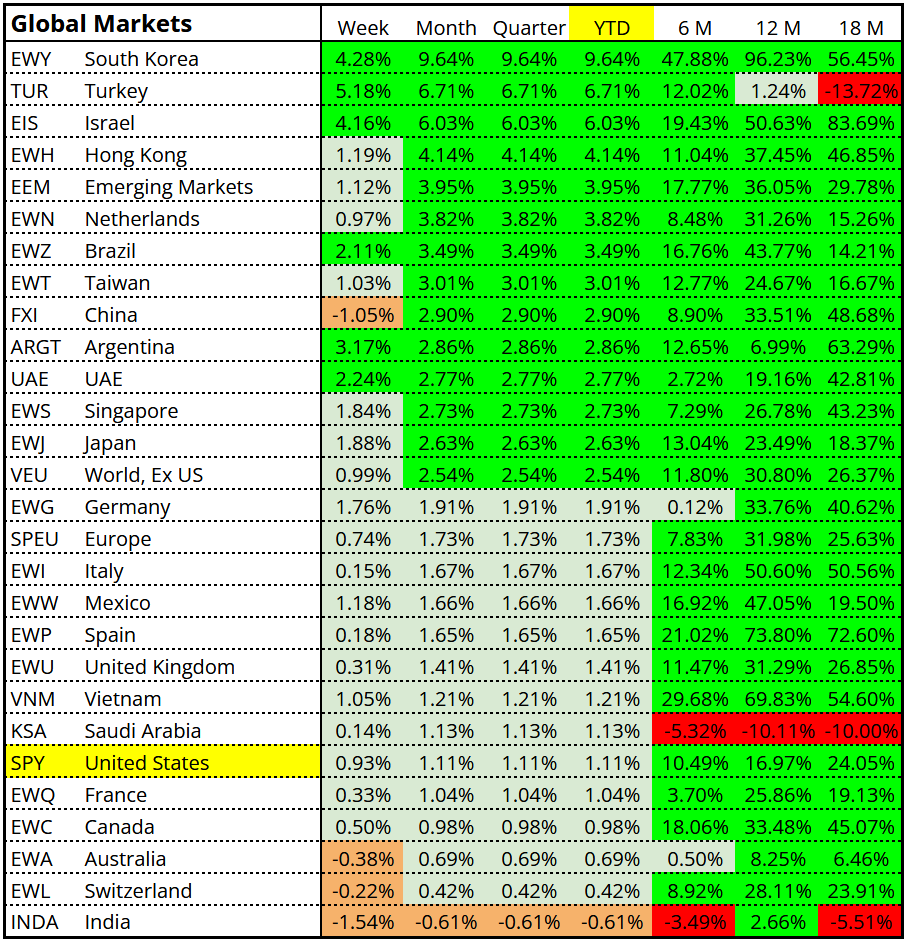

South Korea Is Up Nearly +10%

Amazon Leads The Mag7

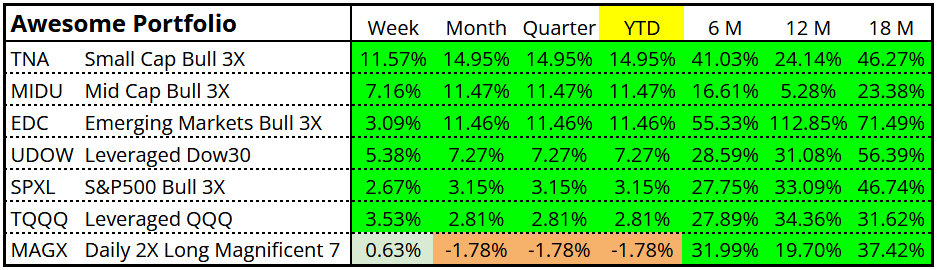

Small/Mid Caps & Emerging Markets Up More Than +10%

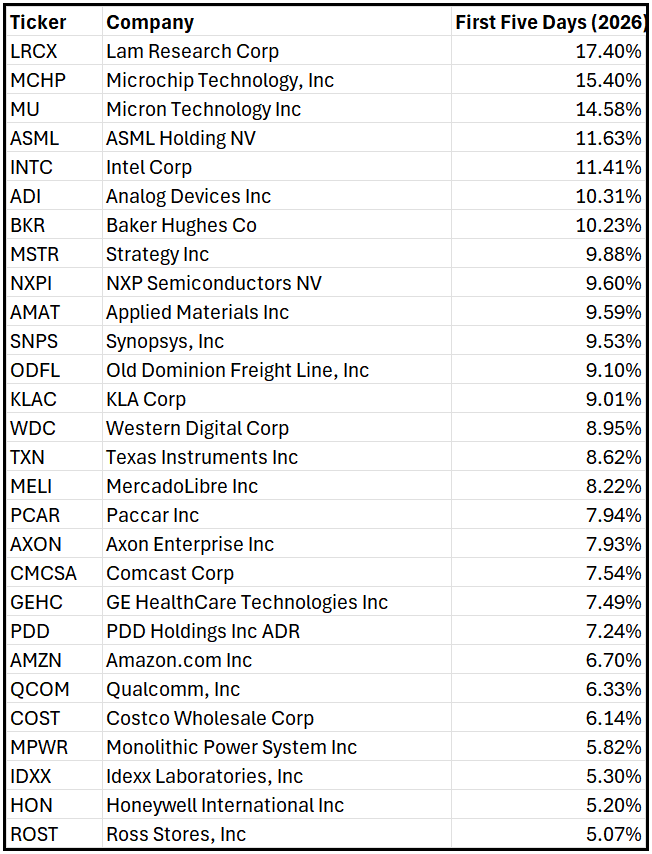

What about stocks?Let’s look below the big four:

Hi Charles. Love the new format and vision. I’ve been along for the ride with you for at least 15 years. Wishing you good health and happiness in the new year.

Very good concise information. I find this very helpful !

Thank you !