Will The Uptrend Continue?

A Probability-Based Roadmap For The S&P 500

No one knows the future.

However, we do know how to evaluate the probabilities based on the price action.

The Bottom Line

The S&P 500 continues to trade within its long-established uptrend. The bullish foundation remains intact, supporting continuation of the trend in both the short and longer term. Until price proves otherwise, the highest-probability position is to remain aligned with the trend.

The Current Setup

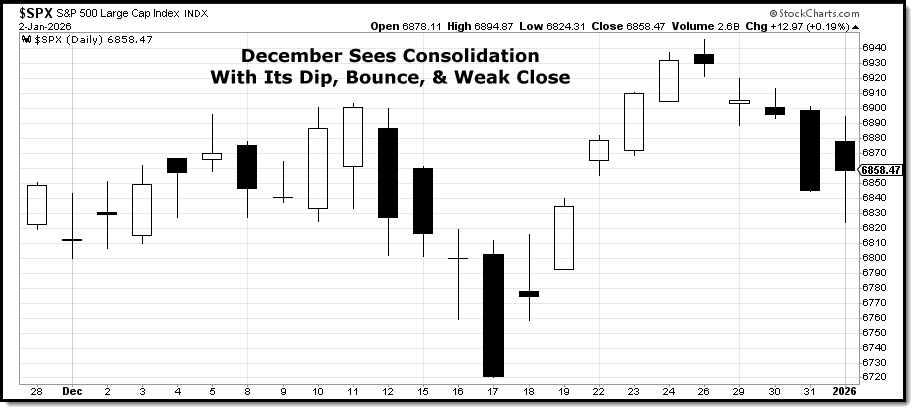

After a strong advance, the S&P 500 spent November and December consolidating sideways within its long, steady uptrend.

A mid-December dip was bought, followed by a breakout to a new all-time high near 6,945 around Christmas, only to give back those gains by month-end.

This type of pause is not unusual. On its own, it is not bearish.

What History Suggests

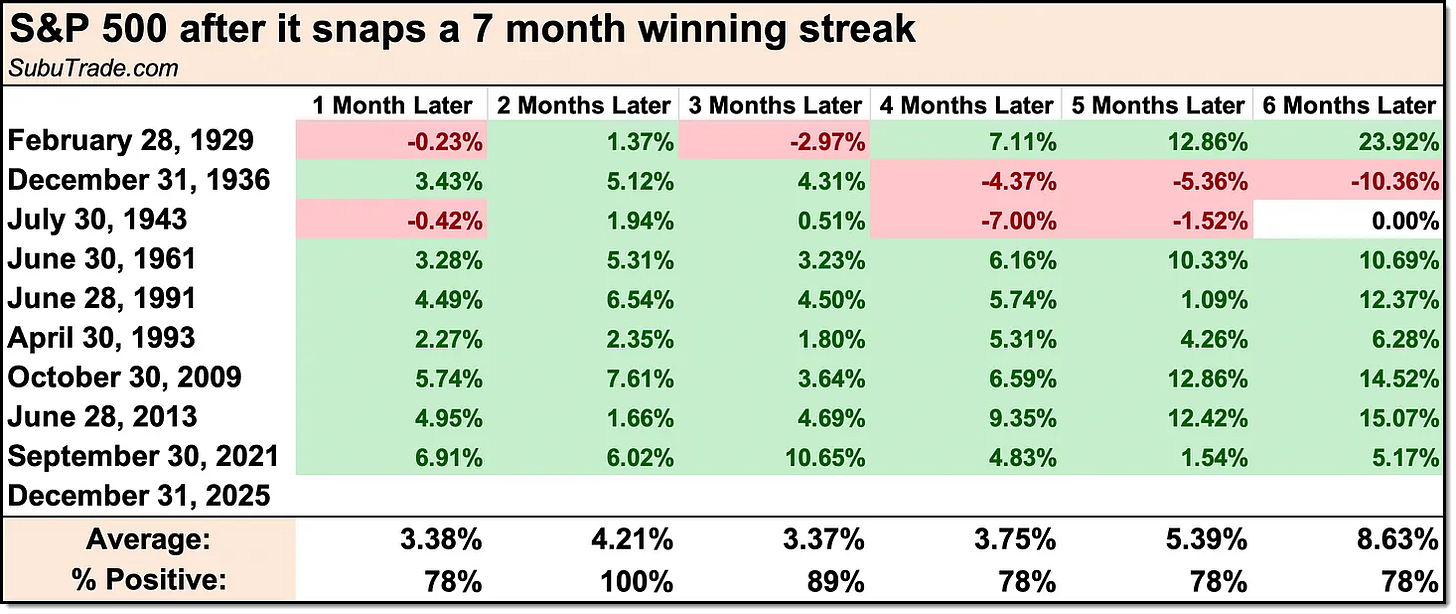

December finished modestly lower (-0.05%), ending a seven-month winning streak.

When these rare long winning streaks end, strength has often returned in the months that follow. More importantly, when continuation did not occur, the pullbacks were modest, particularly over the next several months.

History does not predict outcomes.

It provides context.

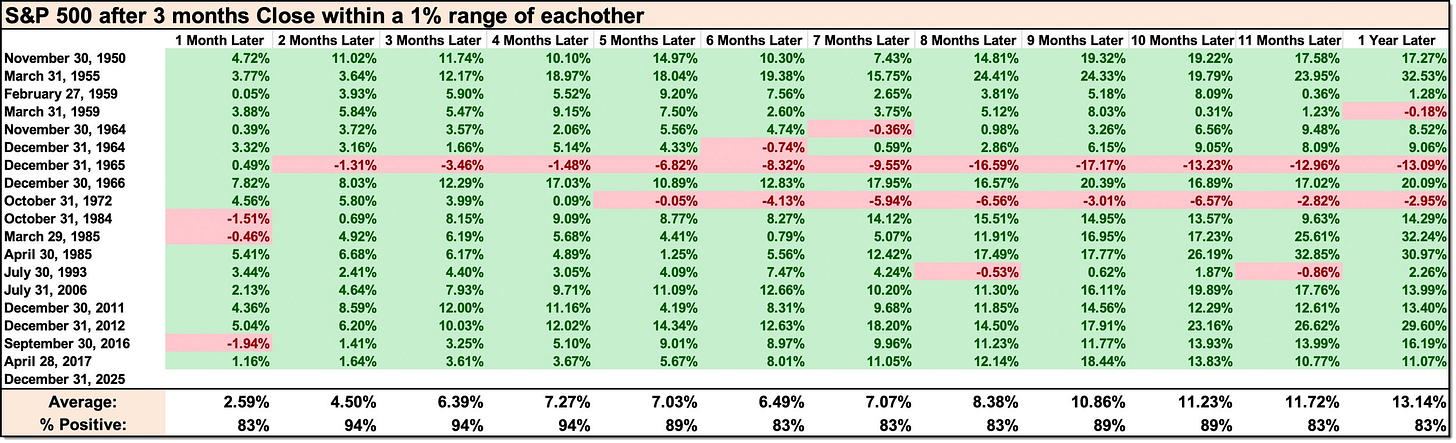

Compression Matters

Over the past three months, the S&P 500 closed within an unusually tight range. Compression of this nature following a strong advance is uncommon.

When markets consolidate, compress, and coil like this, especially within an established uptrend, the odds favor trend continuation across multiple future periods.

Why This Looks Like Uptrend Consolidation

The S&P 500 has now spent more than two months consolidating within an established uptrend.

This behavior looks less like exhaustion and more like the construction of a higher base of support. Price has held near the upper end of the range, pullbacks have been well-contained, and buyers have continued to step in following short-term weakness.

Compression following strength tends to resolve in the direction of the primary trend.

What Would Invalidate This View

This assessment changes only if price changes.

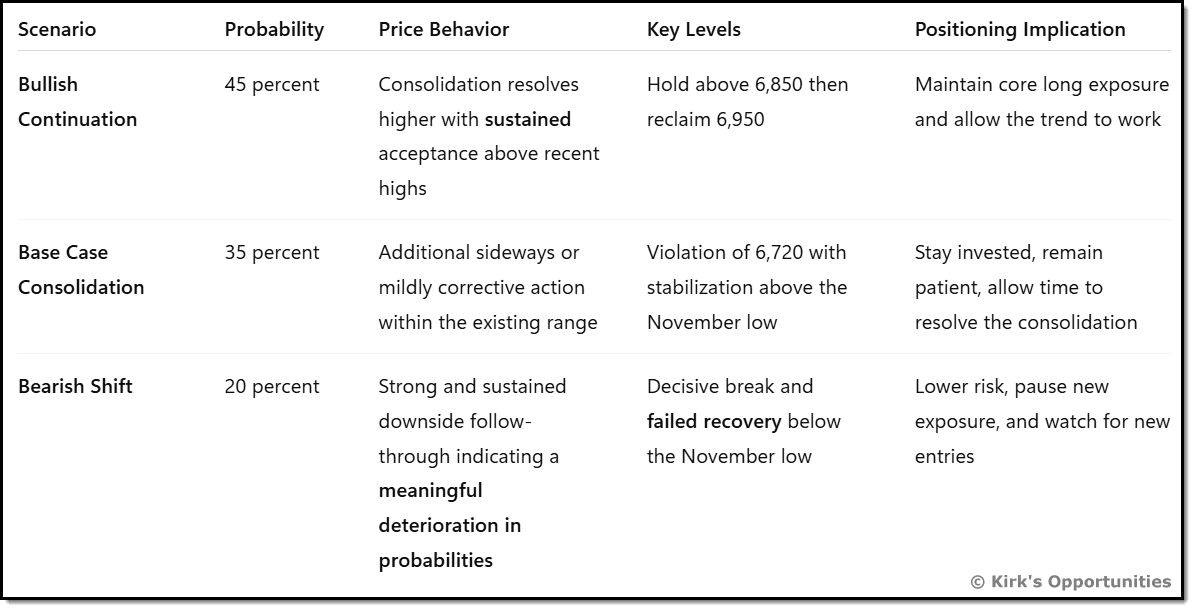

A violation of the December 17th low near 6,720 would not, by itself, signal a failed uptrend. Instead, it would suggest that the market needs more time to consolidate within the current range before the next directional move develops.

A more meaningful shift in probabilities would require a strong and sustained break below the November low. That would indicate that the market is no longer digesting gains but instead transitioning into a less favorable short-term environment.

Until that occurs, pullbacks remain part of a consolidation process rather than evidence of a trend reversal.

S&P 500 Scenario Assessment

Time corrections resolve through patience, trend changes resolve through price.

How to read this table

• Probabilities are based on price action, not opinion

• The base case assumes patience, not inactivity

• The bearish case requires confirmation, not anticipation

• Positioning changes only when price changes

The Opportunity

The opportunity is not prediction.

The opportunity remains on the right side of the price action.

Maintaining core exposure to the S&P 500 through instruments such as SPY, SPYM, IVV, or VOO remains justified by the structure and trend.

I favor staying concentrated, simple, and easy to manage. Complexity often creates the illusion of control while quietly eroding results.

Why No Leverage

Leverage has its moments. This is not one of them.

The current environment favors participation with flexibility, not pressing risk. Gains may continue, but with larger and more demanding pullbacks.

Preserving capital and mental clarity matters more than maximizing exposure.

A Final Reminder

There will always be reasons to fear the uptrend is ending. The bearish argument often sounds more convincing than the bullish one.

Our job is not to predict turning points.

Our job is to watch the price action, evaluate probabilities, and adjust as needed.

I will continue to help you see what I see, so you can use that perspective, challenge it, track it and manage your own investments with greater confidence.

Let us stay on the right side.

“They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side.” - Jesse Livermore

Nice info.

I really like this format of communication with Bear!! So much easier